THE FINANCIAL WAREHOUSE COMPANY

CHARTERED CERTIFIED ACCOUNTANTS

THE FINANCIAL WAREHOUSE COMPANY

Chartered Certified Accountants

SPECIALIST ACCOUNTANTS FOR CHARITIES AND NOT-FOR-PROFIT ORGANISATIONS

Understanding charity funds - Restricted vs Unrestricted Fund

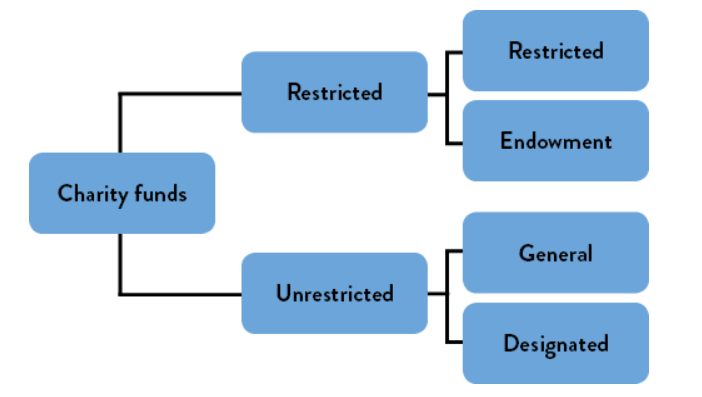

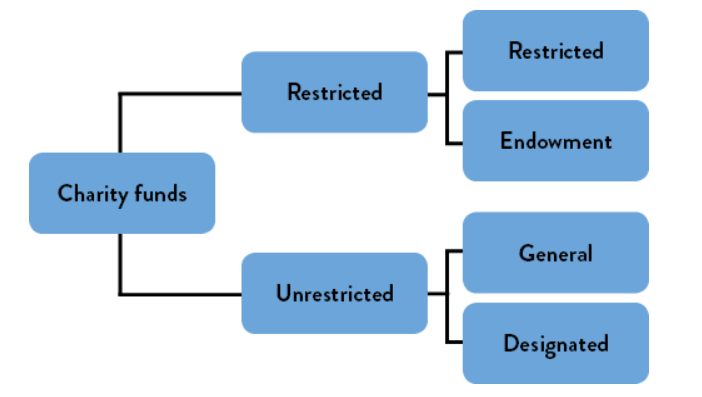

Restricted vs. Unrestricted funds

A big difference between charities and commercial organisations is that Charities use fund accounting. All income received by the charities needs to be categorised under one of these categories.

Unrestricted funds are like a charity's flexible spending money—they can be used for any activity within the charity's purposes.

Designated funds are a subset of unrestricted funds that charity trustees can choose to allocate for specific purposes. These funds remain unrestricted, and trustees can change their designation at any time, as long as the purpose is genuine and not just for show.

On the other hand, Restricted income funds are legally bound and can only be used for specific purposes, which are usually narrower than the charity's overall goals.

Restricted funds come into play under specific circumstances:

1. When a donor specifies that their donation must be used for a particular purpose.

2. When a charity launches a fundraising campaign for a specific cause and collects donations for that purpose.

3. When the Charity Commission orders a charity to establish a restricted fund and contribute to it. Charities can also request permission from the Commission to create a restricted fund.

Endowment funds arise when a gift is given to a charity as a capital asset. There are two types:

- Permanent endowment funds must usually be held indefinitely and cannot be converted into income without permission from the donor or the Charity Commission.

- Expendable endowment funds give trustees the power to convert some or all of the capital into income at their discretion. This typically happens when trustees believe the donor intended for the funds to benefit the charity in the long term.

Defining 'free' reserves:

'Free' reserves are funds that charities can spend on any purpose. However, they have a narrower definition than total unrestricted funds and exclude:

- Tangible fixed assets

- Investments related to specific programs

- Restricted funds

- Designated funds

- Endowment funds (both permanent and expendable)

- Any commitments not accounted for as liabilities.

Charity trustees are often surprised to learn that designated and expendable endowment funds are excluded from the definition of free reserves, given their flexibility of use.

Want more information?

FWCO

Latest news